AI-Powered

Compliance & AML Intelligence for Financial & Non-Financial Institutions

Compliance & AML Intelligence for Financial & Non-Financial Institutions

Instant Access.

Who We Work With

Empowering regulatory compliance across a broad spectrum of licensed financial entities.

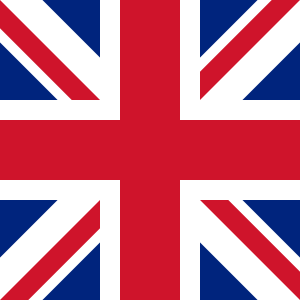

Your Single Source for Compliance Automation, Oversight, and Intelligence

Enterprise-Grade Compliance Infrastructure – Scalable, Secure, Global

Unified Dashboard – Sanctions Screening, expired KYC, Reporting, Risk Rating & Red Flag Alerts

Real-Time Case Management Engine

Automate investigations and dispositions with a Real-Time Case Management Engine that streamlines case tracking, decision-making, and compliance—enabling faster, smarter resolutions.

Role-Based Access Control (RBAC) – Multi-layered Data Security & Audit Trails

API-Enabled Integrations – Seamlessly Connect with Core Banking, KYC, Blockchain Analytics & Law Enforcement Databases

Designed for Confidence.

Simplifying Compliance. Amplifying Results

Non-Financial Institutions

NexSanctions & NexAntifraud

Fintechs & Regulators Globally

RegTech Platform Powered by AI, Built for Global Compliance

NexAML unifies AML, sanctions, and risk management—driven by advanced AI/ML, smart automation, and regulatory intelligence.

Tailored editions for Banks, Fintechs, MSBs, and DNFBPs deliver faster detection, fewer false positives, and real-time case handling with configurable controls.

Monitor transactions, prioritize alerts, and file STRs—all in one unified solution.

Built-In EWRA, Passport Checks & Ownership Visualization

Only NexAML embeds enterprise-wide risk assessment and identity assurance directly into investigations

Instantly map complex ownership/control, verify passports within the profile, and generate dynamic EWRA scores that guide decisions—no extra tools or exports.

See risk at a glance with ownership graphs, live passport verification, and one-click risk profiling.

Unlimited Global Screening with Real-Time List Updates

Screen against UN, OFAC, EU, HMT and more—without gaps or delays.

AI-assisted name matching, de-duplication, and watchlist hygiene reduce noise while preserving full coverage across jurisdictions and languages. Highlight line: Unlimited screening, zero compromise—always synced to the latest lists.

Unlimited screening, zero compromise—always synced to the latest lists.

Configurable Controls, Multilingual UI, ISO-Backed Assurance

Operate confidently with thresholds, scenarios, and workflows you can tune—no code required.

Available in English, Arabic, and French, scalable from SME to enterprise, and continuously improved under certified standards for quality and security.

ISO 9001:2015 & ISO/IEC 27001:2022—security and quality built into every release.

12%

Turn Complexity Into Clarity

Our products give compliance teams the power to see risks as they happen—clear, connected, and actionable. From monitoring transactions to screening sanctions and managing fraud, everything works together to cut noise, highlight what matters, and speed up decision-making. Stay focused on outcomes, not paperwork.

Smarter Risk Insights

Faster Case Resolution

Scalable Compliance

Transparent Pricing

- Task creation and management

- Included money back guarantee

- Competitive price comparison

-

Premium service exclusive features -

Value highlighted clearly -

check Upgrade path expanded

- Task creation and management

- Included money back guarantee

- Competitive price comparison

- Premium service exclusive features

- Value highlighted clearly

- check Upgrade path expanded

- Task creation and management

- Included money back guarantee

- Competitive price comparison

-

Premium service exclusive features -

Value highlighted clearly -

check Upgrade path expanded

- Task creation and management

- Included money back guarantee

- Competitive price comparison

- Premium service exclusive features

- Value highlighted clearly

- check Upgrade path expanded

14-day trial, no credit card required.

Start your risk-free AML experience powered by AI, trusted by compliance teams worldwide.

Explore smart workflows, AI-driven insights, and compliance-ready automation — no commitment required.